New Inheritance Tax (IHT) Threshold - Effective April 2017

Written by Helen Tandy and Olivia Bowen

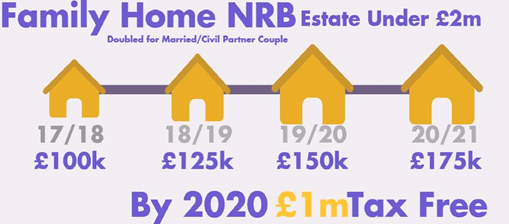

The Government introduced a new IHT nil rate band in the 2015 Summer Budget of up to £175,000 per individual (i.e. a further £350,000 for a married couple) where the family home is passed to children or grandchildren. Although this allowance will not become available until 6 April 2017, it will also be phased in, starting at only £100,000.

This is in addition to the current nil rate band of £325,000 which has been frozen since 2009 and will remain frozen for the next 5 tax years, until 6 April 2020.

Who will benefit

The extra nil rate band will be fully available to anyone who:

-

passes the family home to eligible beneficiaries[1] on death; OR

-

had a family home, then downsized[2] (passing on assets of equivalent value to eligible beneficiaries);

AND

-

has an estate below £2M.

The full £175,000 won't be available until 2020/21. From 6 April 2017 it will start at £100,000, increase to £125,000 6 April 2018, £150,000 6 April 2019 and £175,000 on 6 April 2020. It will then increase in line with the Consumer Price Index (CPI).

Like the existing nil rate band the new property nil rate band can be transferred between spouses or civil partners. This means a married couple could pass £1m from 6 April 2020 to their children tax free on death. Provided the family home is worth at least £350,000 they will save £140,000 in IHT.

Who may miss out?

Not everyone will benefit from the additional IHT free allowance. Anyone with a net estate over £2m will begin to see their property nil rate band reduced until it is completely lost once the estate is over £2.2m (2017/18), £2.25m (2018/19), £2.3m (2019/20) and £2.35m (2020/21).

It will only apply to transfers to children and grandchildren. Meaning those without children will miss out. And it is not possible to use the exemption for lifetime transfers which may discourage some clients from passing on their wealth during their lifetime.

Clients who could benefit from the property nil rate band may need to revisit their existing wills to ensure they continue to reflect their wishes and remain as tax efficient as possible.

So, if you do not leave property to children or leave into a discretionary trust it does not apply.

MEIHTTO/060416

[1] Eligible Beneficiaries

- Direct descendants are blood/step/adopted/foster/have legal guardianship

- Lineal descendants (i.e. Grandchildren)

- Surviving spouse or civil partners of above (i.e. Son/daughter in law of above)

- Trust where direct descendants have absolute right (i.e. Bare trust)

[2] Some rules exist where a property is sold and downsized on or after 8 July 2015.